AI delivers greater value when it reduces friction, simplifies interaction, and improves workflow efficiency.

💬 Geoffrey Moore

AI delivers greater value when it reduces friction, simplifies interaction, and improves workflow efficiency.

💬 Geoffrey Moore

Takaichi walked away from the Feb. 8 vote with a historic landslide, securing a rare two-thirds supermajority in the lower house for her Liberal Democratic Party. The LDP went into the day with 198 seats in the 465-seat chamber and walked out with 316. That’s the largest mandate in Japan’s postwar history, bigger even than any won by Shinzo Abe, Takaichi’s late mentor. The LDP can now override vetoes from the upper house, where it lacks a majority. After cycling through revolving-door prime ministers for years, Japan has elected its most powerful leader since World War II.

💬 Ian Bremmer

A complex system, contrary to what people believe, does not require complicated systems and regulations and intricate policies. The simpler, the better. Complications lead to multiplicative chains of unanticipated effects.

💬 Nassim Nicholas Taleb

Structured Thought Meets Music Meets The Business Equation … and probably more besides.

You say yes, I say no,

You say stop, and I say go, go, go,

Oh no.

You say goodbye and I say hello, hello, hello,

💬 Paul McCartney

First song from Paul after Brian Epstein (no relation) passed on to the next stage of his life …

Wikipedia:

“It’s such a deep theme in the universe, duality – man woman, black white, ebony ivory, high low, right wrong, up down, hello goodbye – that it was a very easy song to write.” McCartney also said that, in “Hello, Goodbye”, he was promoting “the more positive side of the duality”.

Which all came to mind this morning reading 🔗 this post by Manton Reece who observed …

If everyone can ship software, what will distinguish the successful companies from the apps that are lost in the noise?

To which I reply by quoting some lines from a less talented group of songwriters - and yet seem pertinent …

Shooting stars never stop even when they reach the top

💬 Those that believe they have won.

and

The world is my oyster

💬 Everyone else.

.. or perhaps more simply - as one door closes - another opens.

Corollary - not for everyone (the corpses of software companies that litter the technology freeway is testament to that.) … so what do we do?

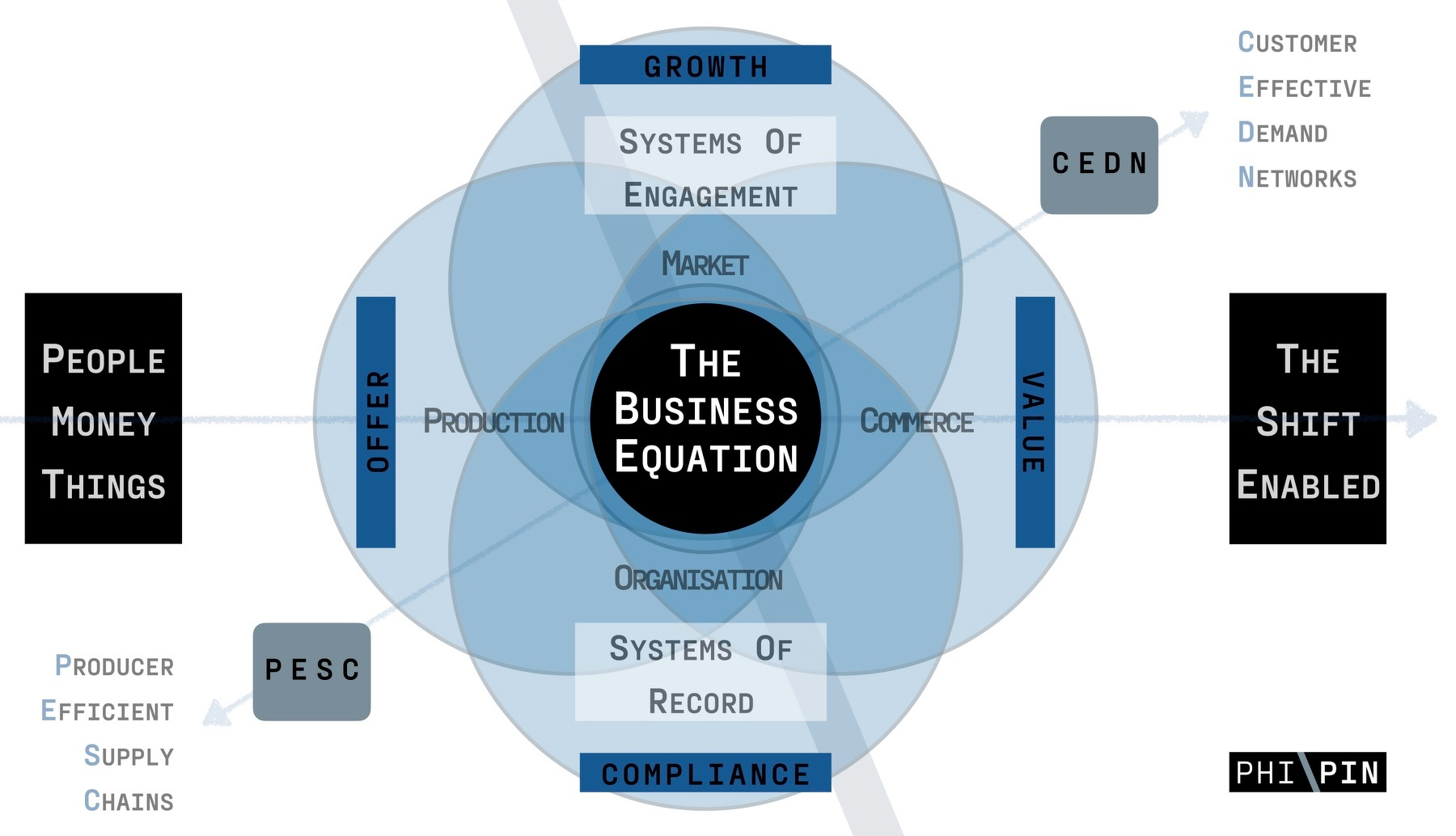

The shift that Manton is describing is right - but IMHO falls short of what a business needs in The Age of Engagement which is pretty much what I have been writing about for a while now ….

Two Foundational Posts

🔗 The Age of Experience is Emerging

Just this past week

🔗 Engagement Platforms as Coherence Infrastructure

Bonus Post

🔗 Marketing in 2025 (and 2026 it turns out)

From a marketing perspective - the 4Ps have been part of the lexicon of any marketeer on this planet since before I was born. But now …

say goodbye

… to the 4Ps: Price, Place, Product and Promotion

say hello

… to The 4Es : Exchange, Ease, Essence and Experience

Price gives way to Exchange

Not what you charge. What you trade. Mutual value.

Place gives way to Ease

Not where you are. How frictionless you make it. If engagement hurts, product dies.

Product gives way to Essence

Not what you make. Who you are - through your customer’s eyes. Stop second guessing.

Promotion gives way to Experience

Not what you say. What they feel. Their perception is your only reality.

You say ‘goodbye’ to ‘Product Efficient Supply Chains’ while I say ‘hello’ to ‘Customer Effective Demand Networks’

(Those are two thought threads of mine that go back to the early oughts and are integral to The Business Equation.)

When everyone can ship code (I know, I know), technical execution becomes table stakes - but I think although Manton’s words are different to my words he is recognising the shift that I keep describing … constraint has moved from PRODUCT to EXPERIENCE.

So - back to Manton’s list;

These aren’t the ‘other aspects’ of running a software business. They are now the primary aspects. Code is just infrastructure. In fact just last week, my friend and partner for the development of the apps we are building said just last week.

The cost of code might be coming down - but people don’t buy code - they buy software.

Actually - being who I am I think they are buying what the software will do for them - but that’s my marketing lens. What Tony was hitting on is right from th pot of what marketeers used to call ‘Full Product’.

The 4Ps assumed scarcity of products, distribution and information, whilst the 4Es assumed abundance where engagement is the only moat.

Manton’s list is actually part of The 4Es.

The Age of Engagement isn’t coming. It’s here. Code is just catching up.

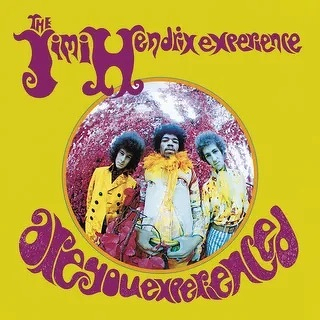

and clearly - Jimi was way ahead of his time! (But we knew that already. Right?)

If you want to set some time to explore how all this can be used to help your business transition into the ‘Age of Experience’. 📅 Let’s Talk

Alright. Your system, your logic.

💬 Claude

Darn Tootin'

💬 Me

💬

Via John Naughton:

Clarinets, like lawyers, have cases, mouthpieces, and they need a constant supply of hot air in order to function.

💬 Viktor Borge

💬

💬

The Super Bowl is this weekend, and I really don’t care who wins it, but I’ll watch the game anyway — because that’s what we do, right?

💬 Dan Lewis

Actually no Dan. We don’t.

We make conscious decisions to make our short lives worth something.