🔗New Zealand loses appeal to rich foreigners as investor visa numbers plunge..

Maybe they have been reading Rushkoff’s book - and don’t want to be put in the same bag as Peter Thiel?

It was bizarre. I do get called out a lot to do these talks for businesspeople about the digital future. So, it was one of those where they paid me a bunch of money to convince me to spend some jet fuel and leave my home and pontificate, but then instead of taking me out onto the stage, they brought these five guys into the green room and sat around this table and started asking me all these very binary questions about where they should place their bets for the digital future: Bitcoin or Ethereum; VR or AR; and finally, New Zealand or Alaska—where should they invest in land to put their bunker for “the event”?

💬 Douglas Rushkoff

(my bold)But still ….

It’s not just rich foreigners not arriving - it’s ordinary people leaving … again.

All kinds of reasons - but just from my own peculiarly tight Kiwi circle

-

me - of course - though I haven’t abandoned the country completely!

-

a kiwi friend and his wife moved to Portugal in January.

-

a highly networked and successful tech entrepreneur who has built his businesses in New Zealand for the last 30 years, very well connected, recognized by many for his contribution to the country has hit a wall and is looking at the US and The Far East as new opportunities. His words;

“In New Zealand there is zero appetite in thinking beyond the shores of the country.

- an internationally successful VC who had spent the last two years in New Zealand seeking to kick start an incubator and accelerator wrote to me last week;

My overall experience in NZ shows that it is a country that is too small and internally focused to get meaningful traction as an innovator, not impossible, just a smaller pond and appetite …. I plan to build connections in Australia and further regionally in Asian markets this year.

- a good American friend who has lived in Aotearoa for the last 8 years. Again, accomplished and connected and still can’t get local traction, yet without trying is fielding calls from Singapore, Vietnam and Malaysia.

But there’s more. COVID saw a lot of Kiwis returning ‘home’. COVID has ‘moved on’ (well - we all know it hasn’t - but it is clearly now manageable), net result, the Kiwis are back out on the road again.

Example - just like the UK, there is a severe shortage of healthcare professionals just one of many articles .. a shortage of 4,000 people (this in a country of 5 million people). If a similar ratio were applied to the US, there would be a shortage of over 1/4 million healthcare workers!

Here’s the rub … in my three years in New Zealand I lost count of trained healthcare professionals (and accountants and engineers for that matter) who were driving for taxi companies and Ola. (I am sure that the same applied to Uber - but can’t speak to that, because - well - Uber ). Why? Because New Zealand requires them to go through all their training again. (Not just pass exams - but actually retrain.)

Meanwhile - a Kiwi trained Healthcare professional can fly out of Auckland, land in Sydney, get paid more and have a lower cost of living.

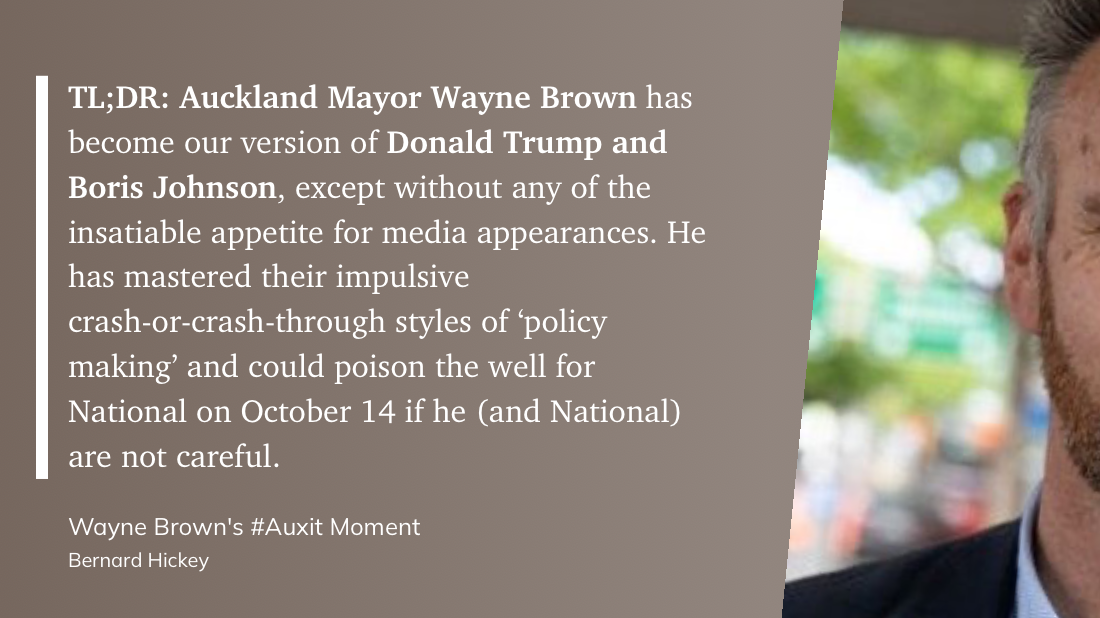

There’s a lot more around the challenges that New Zealand face - which I’ll save for another day - just to leave you with a couple of quotes from Bernard Hickey - a Kiwi journalist and political commentator based in Wellington. (again - my bold.)

Wayne Brown is actually simply expressing a view held by most asset owners and investors in Aotearoa-NZ’s economy, or as I call it, a housing market with bits tacked on. That deeply held and and so-far-extremely-profitable investment strategy is that owning shares or investing in businesses in Aotearoa is vastly inferior to owning land, especially leveraged residential land, and even better if it is residential-zoned land that remains banked and undeveloped. The

Wayne Brown (ed - the new major of Auckland) is being exactly what he is: a property developer who has actually made most of his personal money from land price appreciation on land made valuable through rezoning and paying for water connections at a lower-than-full cost.